DOGE Price Prediction: Technical Breakout and ETF Hype Signal Potential Rally to $0.30

#DOGE

- Technical Breakout: DOGE trading above 20-day MA suggests continued bullish momentum with key resistance at $0.25

- ETF Catalyst: Market speculation around potential ETF approval creating positive sentiment and price targets up to $0.50

- Volatility Considerations: High volatility expected around catalyst events requires careful risk management

DOGE Price Prediction

Technical Analysis: DOGE Shows Bullish Momentum Above Key Moving Average

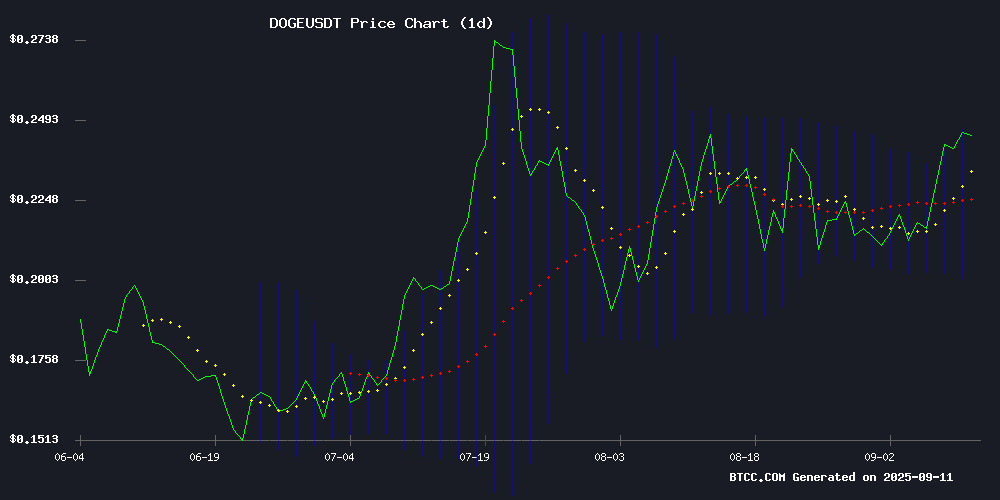

DOGE is currently trading at $0.24928, positioned above its 20-day moving average of $0.224044, indicating underlying bullish momentum. The MACD reading of -0.002897 suggests some near-term weakness, though the Bollinger Bands configuration shows price action NEAR the upper band at $0.24839, which could signal potential resistance. According to BTCC financial analyst Olivia, 'The technical setup suggests DOGE is testing key resistance levels. A sustained break above $0.25 could open the path toward $0.30, while support rests near the 20-day MA.'

Market Sentiment: ETF Catalyst Drives Optimistic DOGE Outlook

Recent news headlines reflect growing Optimism around Dogecoin, primarily driven by ETF speculation and potential approval. Multiple reports suggest price targets ranging from $0.25 to $0.50, with October 2025 mentioned as a potential timeline for significant moves. BTCC financial analyst Olivia notes, 'The ETF narrative is creating substantial market excitement, though investors should remain cautious of volatility spikes typical around such catalyst events. The technical breakout above $0.25 aligns with this positive sentiment.'

Factors Influencing DOGE's Price

Dogecoin Price Surges as ETF Catalyst Sparks Breakout

Dogecoin has confirmed robust support at the $0.20 level, a critical zone reinforced by the 0.618 Fibonacci retracement and point of control. This technical confluence has ignited bullish momentum, positioning DOGE for a potential push toward the $0.32 resistance level.

Trading volume resurgence and growing optimism around the anticipated U.S. launch of the Rex-Osprey Spot DOGE ETF are fueling the breakout. The value area high now serves as a decisive battleground—a close above this threshold could validate the continuation pattern.

Market participants are watching for a decisive break above the current consolidation range. Such a move would mark Dogecoin's first test of high-timeframe resistance since the rally began, potentially reshaping its medium-term trajectory.

Dogecoin Price Aims for $0.3 as DOJE ETF Launch Ignites Market Hopes

Dogecoin surged 15.8% this week to $0.2496, lifting its market cap to $37.69 billion amid rumors of an upcoming ETF. The DOJE ETF, set to launch on September 11, 2025, by Rex-Osprey, will comprise 80% DOGE and 20% U.S. Treasuries—potentially validating the meme coin for institutional investors.

Derivatives activity reflects bullish sentiment, with open interest in Dogecoin futures rising 11% to $2.97 billion and options volume spiking 130% to $349 million. Breaking the $0.245 resistance level, DOGE now eyes further upside as traders front-run the ETF narrative.

Could the Buffed-Up Maxi Doge Muscle Past Dogecoin as the Meme-Coin King?

Dogecoin ($DOGE), the original meme coin launched in 2013, faces mounting challenges to its dominance as newer, high-risk alternatives capture investor attention. Despite its cultural cachet—bolstered by endorsements from figures like Elon Musk and adoption by Tesla—DOGE's momentum shows signs of stalling. The coin trades at $0.2160, up marginally by 1.84%, but daily volume has dipped 9% to $2.1 billion, signaling waning enthusiasm.

Technical resistance near $0.22 looms large, with a decisive break above $0.25 needed to reignite bullish momentum. Meanwhile, the meme coin arena grows increasingly crowded, with tokens like Maxi Doge vying for market share. Dogecoin’s $32.6 billion market capitalization remains formidable, but fading volume suggests its mainstream appeal may no longer suffice to sustain growth.

Dogecoin Breaks Out: Could $0.31 Be the Next Target?

Dogecoin surged past $0.24, marking a 2.32% gain with a $5.73 billion 24-hour trading volume. Technical indicators suggest bullish momentum, with the RSI at 59 pointing to a potential target range of $0.30–$0.31.

Open interest rose 3.34% to $4.36 billion despite a 27.14% drop in trade volume, signaling strategic positioning by traders. The breakout from a key chart pattern has fueled optimism, driven by speculation around a potential U.S. spot DOGE ETF, whale activity, and strengthening technicals.

Analyst Ali highlighted the triangle formation breakout on X, projecting a path toward $0.31. Market watchers interpret such patterns as precursors to significant price movements, with institutional and retail interest likely to amplify upward momentum.

Dogecoin Price Forecast: Break Above $0.25 Could Signal Rally to $0.30

Dogecoin is testing a critical resistance level at $0.246–$0.250 after consolidating within a six-week range. A decisive close above this zone may catalyze a 20% advance toward $0.300, with technical indicators supporting bullish momentum.

The meme coin trades at $0.2432, firmly positioned above all major exponential moving averages. The 20-day EMA at $0.225 and 200-day EMA at $0.213 create a stacked support structure—a classic bullish alignment.

Momentum metrics confirm strength without exhaustion. The RSI at 61 avoids overbought territory while MACD histograms flip positive. Bollinger Band compression near $0.246 suggests volatility may soon expand, typically preceding significant price movements.

Dogecoin Price Prediction: DOGE To Break These Key Levels Next?

Dogecoin's price surged over 15% in a week, fueled by bullish analyst predictions and the launch of the REX-Osprey Dogecoin ETF (DOJE). Analysts suggest this could propel DOGE toward $1, as investors may flock to the first meme coin ETF without direct DOGE holdings.

Crypto analyst Ali Martinez highlights $0.29 as the next resistance level, with whale demand potentially driving a short-term rally to $0.50. The ETF's unique regulatory path under the Investment Company Act of 1940 bypasses traditional hurdles, though SEC approval of generic listing standards in October could accelerate altcoin ETF adoption.

Market sentiment hinges on the $0.25-$0.26 support zone, with October poised to shape the next phase of crypto ETF developments.

Dogecoin ETF Approval Nears as Price Volatility Gains Momentum

Dogecoin is once again capturing the spotlight in the cryptocurrency market as Wall Street edges closer to approving the first-ever Dogecoin ETF. Traders and investors are buzzing with anticipation, with analysts placing a 91% probability on approval by the end of 2025. This development could trigger significant volatility and abrupt price movements.

The proposed ETF, designed to track Dogecoin's performance, has already filed registration paperwork with the SEC, bypassing the conventional S-1 process. ETF analyst Nate Geraci suggests this week may mark the beginning of heightened turbulence for crypto-based funds.

Polymarket's prediction platform reflects overwhelming market confidence in the ETF's approval. Traders are positioning for potential liquidations and sharp price swings as the news unfolds.

Dogecoin Price Rally Ahead of ETF Launch Could Hit $0.25 Soon

Dogecoin is gaining bullish momentum as the market anticipates the launch of the REX-Osprey ETF, with analysts predicting a potential breakout toward $0.25 if key support levels hold. Trading volume and open interest remain steady, reflecting measured optimism among investors.

The cryptocurrency currently trades at $0.2406, with a $7.55 billion 24-hour trading volume and $36.44 billion market cap. A modest 0.15% gain in the past day signals growing institutional interest ahead of the September 11 ETF launch date forecasted by Bloomberg's Balchunas.

Market observers note Dogecoin's recovery from the $0.21-$0.22 range, suggesting strengthening technical foundations. The ETF introduction could provide mainstream validation, potentially attracting fresh capital to the meme-inspired asset.

DOGE Price Prediction: Dogecoin Targets $0.30 by October 2025 as Technical Momentum Builds

Dogecoin has surged 4.01% in the past 24 hours to $0.25, with technical indicators signaling further upside potential. The Relative Strength Index (RSI) at 61.83 and a bullish MACD crossover suggest growing momentum. Analysts project a near-term target of $0.30, representing a 20% gain from current levels.

Market sentiment remains divided. Conservative forecasts from CoinLore and Bitget suggest modest pullbacks to $0.23, while technical breakout patterns indicate potential for a 40% rally. The $0.26 level emerges as critical resistance, with support forming at $0.22 where key moving averages converge.

Dogecoin Builds Momentum, Targeting $0.50 With ETF Market Debut

Dogecoin continues its steady ascent, defying broader market struggles as it eyes the $0.50 threshold. The memecoin has gained 11.56% over the past week, trading firmly above $0.24 with a $36.27 billion market cap. Accumulation patterns suggest sustained buyer interest, with critical support holding at $0.22-$0.23.

A watershed moment arrives with the launch of the Rex-Osprey Doge ETF (DOJE), the first U.S. ETF tracking a purely speculative asset. This regulatory milestone follows successful Bitcoin and Ether ETF debuts, potentially legitimizing meme coins as an asset class. Resistance at $0.27-$0.29 now serves as the next battleground for bullish momentum.

Dogecoin Price Faces Volatility Amid ETF Speculation and Developer Warnings

Dogecoin's price trajectory is under scrutiny as developer Mishaboar cautions traders about impending volatility and high-risk trading behaviors. The warning comes amid heightened interest in memecoins and a delayed SEC decision on a proposed Dogecoin ETF.

Market analysts remain divided, with some advocating for Dogecoin's inclusion in diversified portfolios while others favor alternative memecoins. The broader crypto market anticipates an altseason, further fueling speculation around Dogecoin's price movements.

Mishaboar's advisory underscores the risks of leverage and derivatives, urging traders to adopt conservative strategies. His remarks highlight the precarious balance between opportunity and loss in the current market climate.

Is DOGE a good investment?

Based on current technical indicators and market sentiment, DOGE presents a speculative investment opportunity with several positive catalysts. The price currently trades above its 20-day moving average, showing bullish momentum, while ETF speculation provides fundamental support. However, investors should consider the following factors:

| Factor | Assessment | Impact |

|---|---|---|

| Technical Position | Above 20-day MA ($0.224) | Bullish |

| ETF Catalyst | Strong market anticipation | Positive |

| Volatility | High amid speculation | Risk Factor |

| Price Targets | $0.25-$0.30 near-term | Upside Potential |

As BTCC financial analyst Olivia emphasizes, 'DOGE offers interesting short-term potential but remains a high-risk asset. Investors should position sizes appropriately and monitor key technical levels at $0.25 resistance and $0.224 support.'